Conditions Mostly Favorable

Market Update

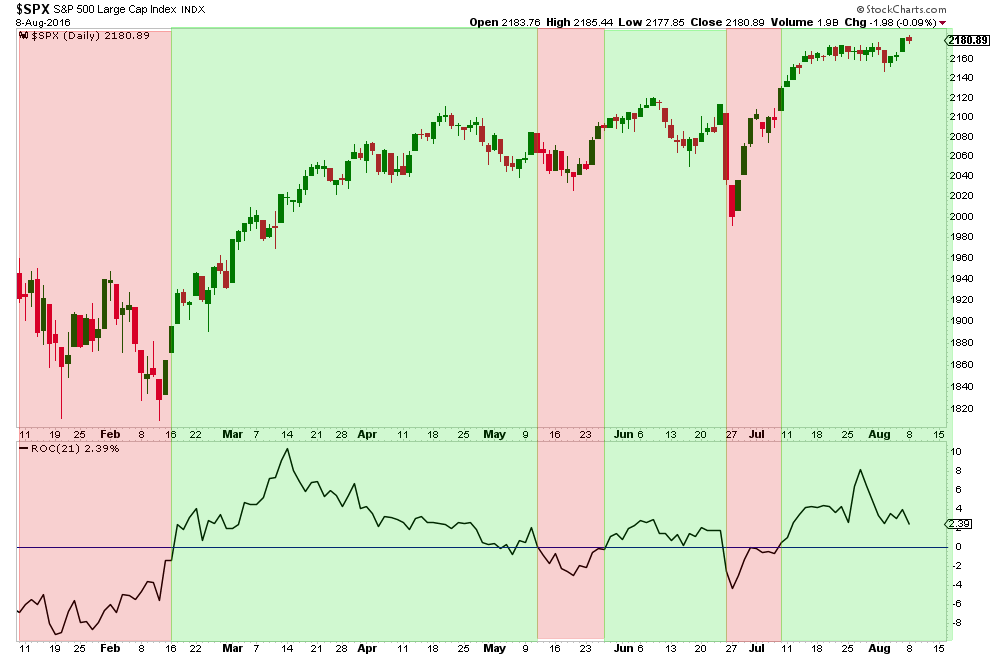

The S&P 500 is in an uptrend (Chart Below) and has held above its all-time high (so far) which has acted as resistance for over a year. In addition, the 10, 50 and 200-Simple Moving Averages are all trending higher. The bottom line is that price action is currently positive for the stock market.

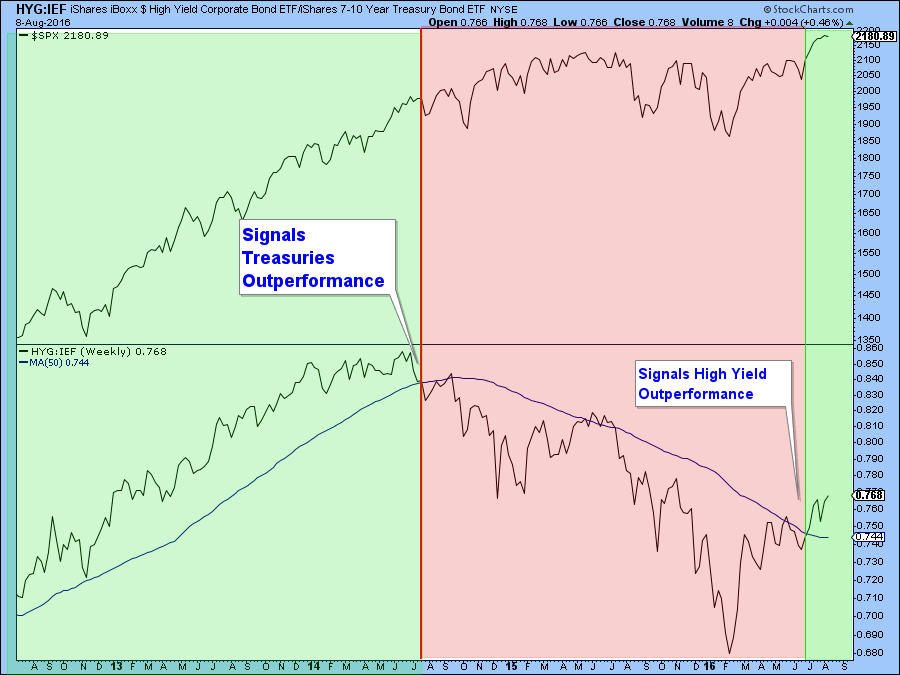

Below is a weekly chart of the relative performance of HYG (a High Yield ETF) versus IEF (a Treasury Bond ETF) in the lower panel and the S&P 500 in the upper panel. When relative performance for defensive Treasuries are outperforming aggressive High Yield Bonds, the line falls indicting investor lack of appetite for risk. I use a move below or above the 50-day moving average as a signal. As you will notice, the relative performance line recently crossed above its 50-day moving average suggesting investor preference for riskier assets. This is long-term positive for stocks.

Stock market momentum is also positive. Below is a chart showing the 21-Day Rate-Of-Change line in the lower panel and the S&P 500 in the upper panel. When the ROC line is above zero, stock market momentum is positive and is negative when below zero.

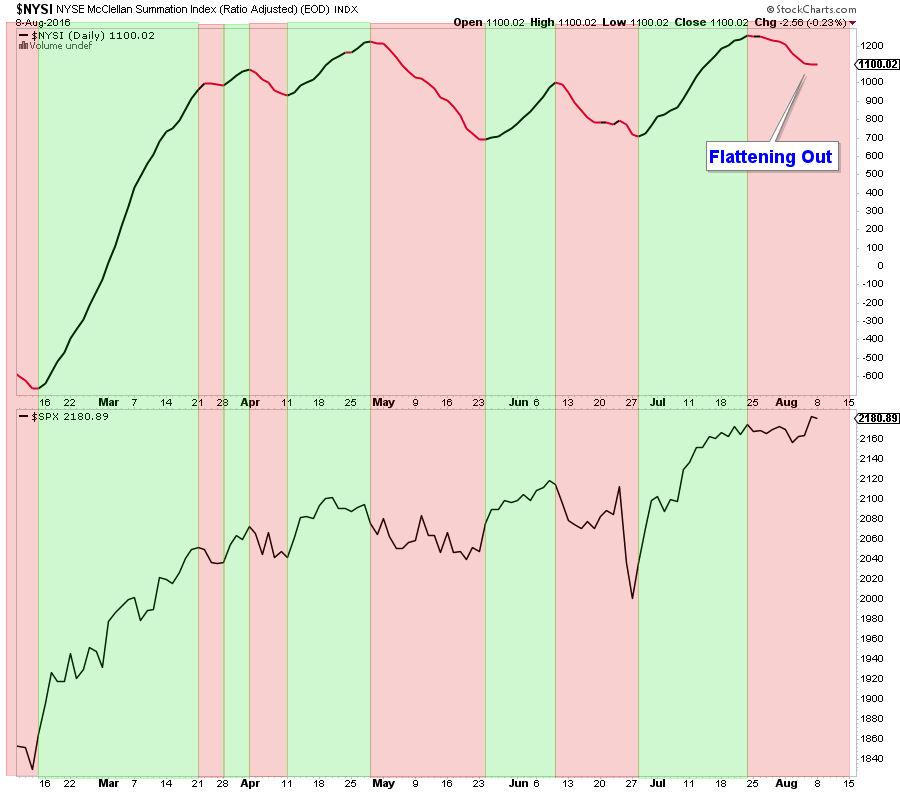

Market breadth indicators did turn negative a couple of weeks ago, and this was one of the reasons I thought odds favored a short-term stock market pullback.

Below is a chart of the NYSE Summation Index (a Breadth Indicator) and even though it is falling; it is starting to flatten out. If stocks gain a little momentum here, it would not take much for this indicator to turn positive.

The Bottom Line

Bias: Positive for Stocks

Stocks have been churning sideways, digesting the gains from the strong advance that began in late June. This sideways market action is sometimes the markets way of taking a breather before resuming the prior uptrend.

Market breadth is still negative, but is close to possibly turning positive which would signal a resumption of the previous uptrend.

Long-term, stock market conditions look positive.

Client Update

Client accounts are between 80% to 100% invested in lower volatility funds.

We sold one or two positions (in some of our client account) early last week due to what we viewed as deteriorating short-term market internals. We will be looking to buy back into funds that we have identified as providing attractive risk-adjusted return characteristics once these conditions turn positive.

For the most part, our accounts have trended up with very minor volatility this year.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.