Complacency a Concern for Stocks Another week, another stock market rout. The S&P 500 is down 8% for the year and 11.76% from its peak. Most stocks are doing worse. For example, the Russell 2000 (Small Cap Index) is 22.23% off its high.

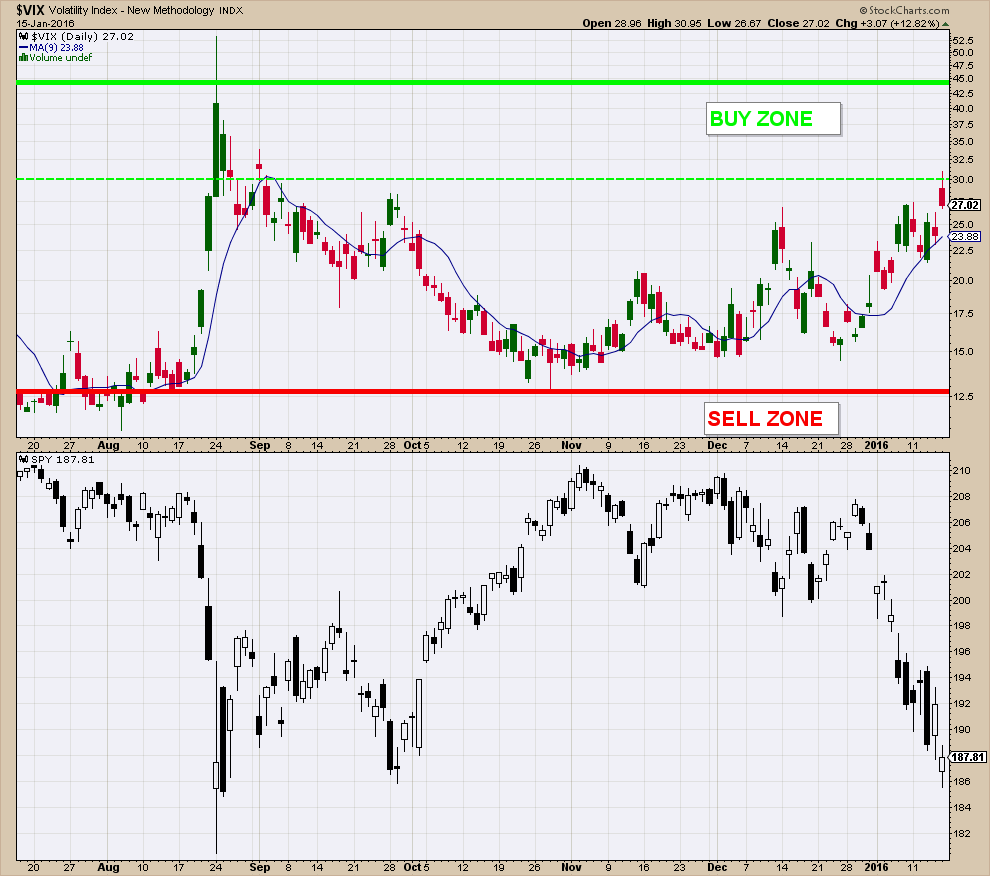

Given the severity of the slide in stocks, you would expect some panic on the part of investors. However, that does not seem to be the case, at least based upon how the VIX is reacting.

While the VIX has risen, it has not reached the levels it hit during last year’s market drop. On August 24, 2015 the VIX hit 53 intraday. Friday the market fell 2.16% and the VIX topped out at 30.95.

During bear markets, stocks have a tendency to become more oversold than they would in a bull market. At this point, I don’t see the capitulation that would normally precede a market bottom.

Client Update

Aggressive accounts are 100% invested in a Money Market Fund.

Conservative accounts are 30% invested in High Yield Municipal Bond Funds and 70% in a Money Market Fund.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066