The weight of the evidence continues to indicate that we are in a bull market and should be invested aggressively in stocks. However, now is not the time to be complacent because we are at the tail end of this period of economic expansion.

Stock Market Update

Bias:

Positive for Stocks

- The stock market is making higher-highs and higher-lows, the 50-day moving average is above the 200-day moving average and both those averages are trending higher, and Thursday’s market close hit an all-time high. We are in a bull market.

- The weight of the evidence is bullish for the stock market in the near term.

- Longer-term (10 months – 3 years), the risk of transitioning into a bear market is going to escalate progressively as the yield curve continues to flatten. A flattening yield curve is normally positive for stocks; however, an inverted yield curve has historically been very accurate in predicting a recession albeit with considerable lead time. We are only about 25 basis points (1/4 of a percent) from inverting. Bottom line is that while we are currently in a bull market, we are in the late innings of this period of economic expansion and bull market.

Client Update

Client accounts continue to be highly invested in various stock mutual funds, individual stocks, and stock exchange-traded funds.

Summary of How I Manage Client Accounts:

- I do not use a buy-and-hold approach like most financial advisors. I believe this strategy, while good for young investors, can have severe adverse consequences for those in or near retirement.

- I use technical analysis to manage risk and preserve principal during major stock/bond market corrections (Bear Markets).

- I have two basic models that I use to manage client accounts. One is conservative and appropriate for investors that are in or near retirement, and an aggressive model for younger more aggressive investors.

- I am a risk manager and will increase our risk level when risk in the market is low, and decrease our risk when risk in the market is high. There have been numerous times in the past where I had clients mainly in money market funds because of high stock market risk.

- I currently view stock market risk to be low and thus I have client accounts invested with a very high percentage allocated to stocks.

Market Technicals

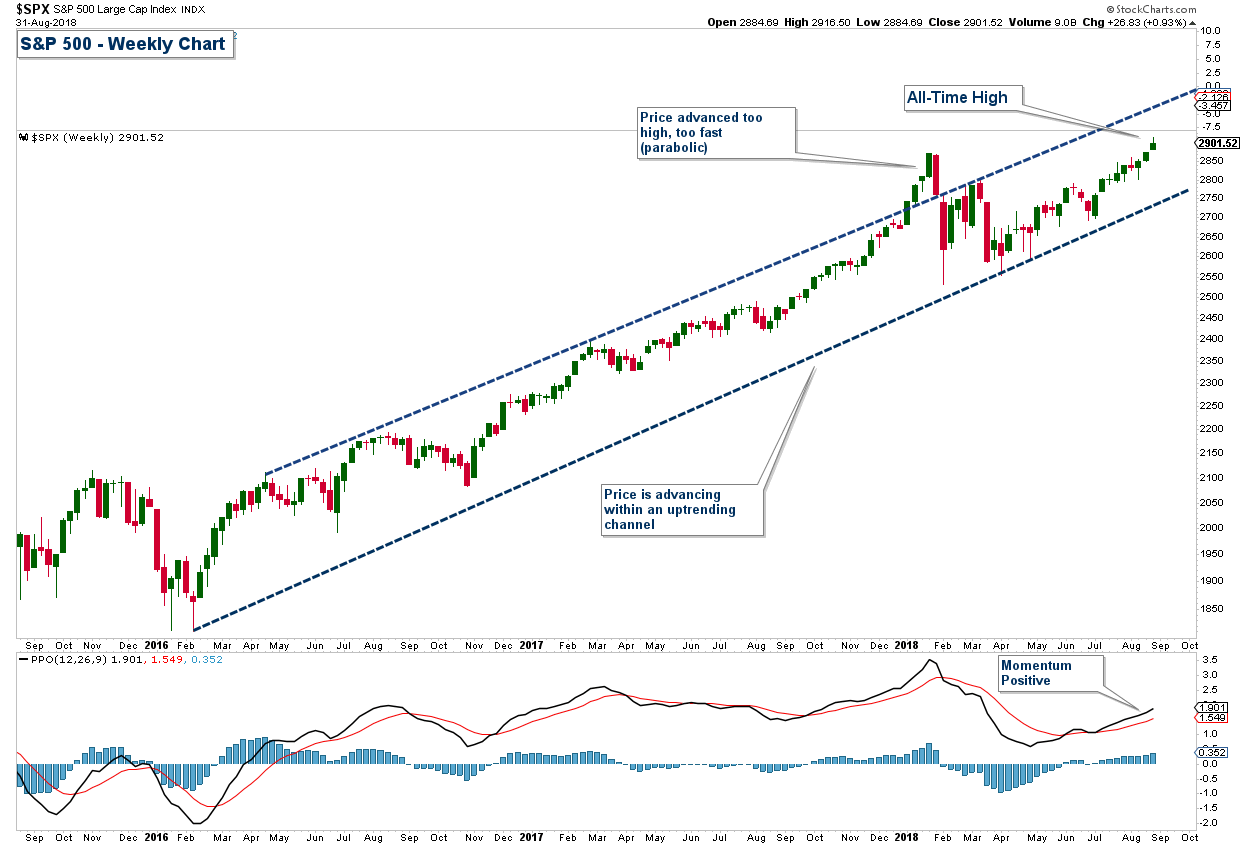

The S&P 500 (a proxy for the broader stock market) is trending higher and price has mostly been contained within an up-trending channel since the mini-bear market of 2015. I call it a “mini” bear market because the definition of a bear market is a drop of at least 20% in the stock market. While the S&P 500 did not fall 20% during that market drop, more than 50% of the stocks on the exchange did.

In the weekly chart below, you will notice that price did violate the upper channel last January. That was the result of a parabolic price move, meaning price moving too high, too fast. The drop that followed was just the markets way of getting price back into a more sustainable advance.

Price is what matters most, and the market hit an all-time high this week and the 50-day moving average is above the 200-day moving average (not shown in the chart). We are in an uptrend, market breadth is positive, and risk-on assets continue to lead the market higher. Bottom line is that in the near-term we are in a bull market and we should continue to be heavily invested in stocks.

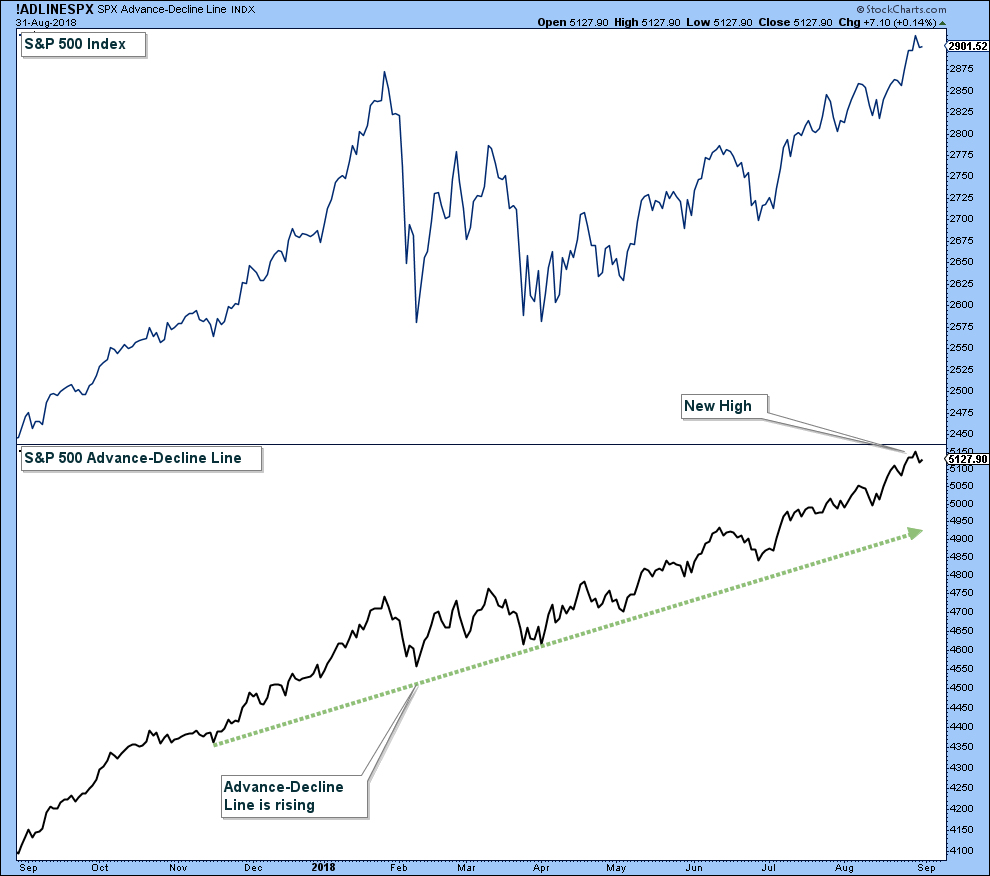

The advance-decline line continues to trend higher and hit new highs, which confirms the market’s advance. Market breadth is currently positive.

10% drops in the stock market (much like we saw in January) are a normal occurrence in a bull market. What will typically cause a bull market to transition into a bear market is a recession. The S&P 500 historically has fallen an average of 32% during past bear markets and a bear market lasted about 15 months, on average. Those are the markets that can cause severe losses in a retirement account if you are using a buy-and-hold strategy. In order to protect principal in my client accounts, I use technical analysis to evaluate market conditions and look to move to a defensive allocation when the risk of a bear market is elevated.

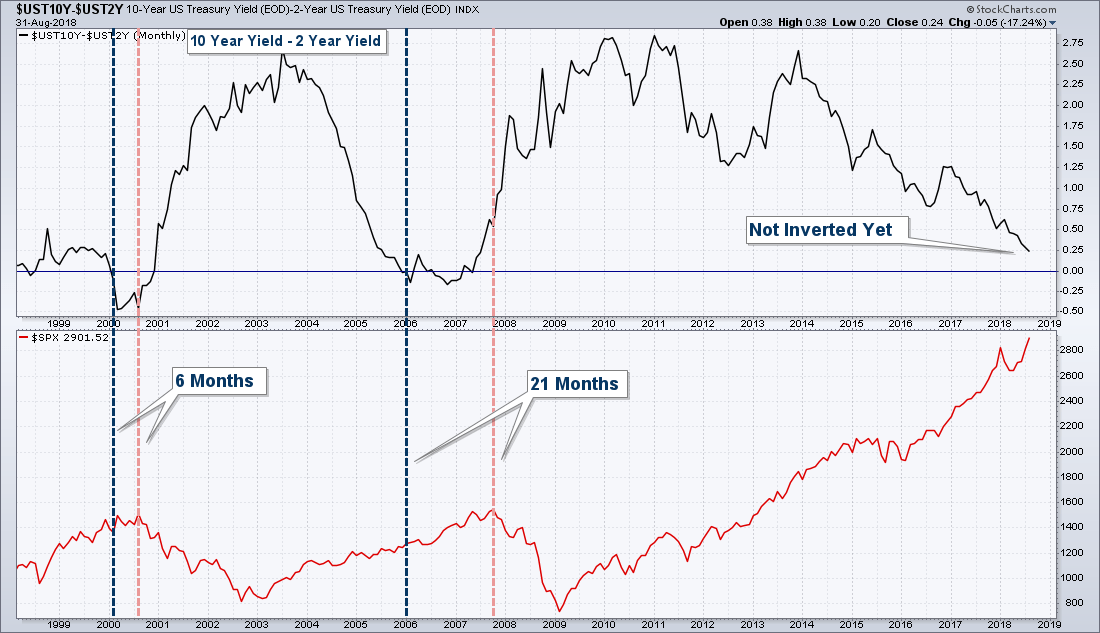

One of the charts that I monitor to give me an idea as to whether a recession is imminent is the yield curve because it has been very accurate in the past in predicting a recession and bear market; however, it does tend to invert months before a stock market peak.

A flattening yield curve much like we are seeing currently has historically been positive for stocks. However, when it inverts, meaning short-term yields are higher than long-term yields, it is a forewarning that we are probably heading for a recession.

Below is a chart of the yield curve in the upper panel and the S&P 500 in the lower panel. The yield curve line is the difference between the 10-year yield and the 2-year yield. So right now it is sitting at .25. This means that the 2-year yield is only .25% below the 10-year yield. Notice how the yield curve line has been trending down. This has historically been positive for stocks. However when the line crosses below zero it means that the yield curve has inverted and that usually signals an impending recession but with considerable lead time. Notice the last two times that the yield curve inverted. In 2006 it inverted and the stock market peaked 21 months later, and in 2000 it peaked 6 months later.

In summary, the yield curve has not inverted yet and even when it does the lead time for a stock market peak can be considerable. Yet, it is something to monitor given we are at the end of the current period of economic expansion. So yes we are in a bull market and should be invested heavily in stocks; however, the bull market will not last forever and we are probably at the tail end.

If you have any questions or would like me to review your portfolio, please feel free to contact me.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.