Bond yields have been falling for 35 years. Think about that for a second. In 1981 the yield on a 10-Year Government Bond was over 15%. Now it sits at around 2.3%. Bond prices are inversely correlated to bond yields. As a result, Treasury Bond prices have trended higher over that time frame. I know what you are thinking. What does this have to do with me?

Well if you have money invested in interest rate sensitive bonds, it means a lot. Most investors buy bonds for safety. But what happens when yields start to rise? Those bonds will lose value. So that part of your portfolio that you thought was safe could actually be poised to fall in value – possibly a lot.

A bond that matures in 20 years that has a coupon rate of 4% would lose about 23% of its value with only a 2% rise in yields. That is a lot of downside risk!

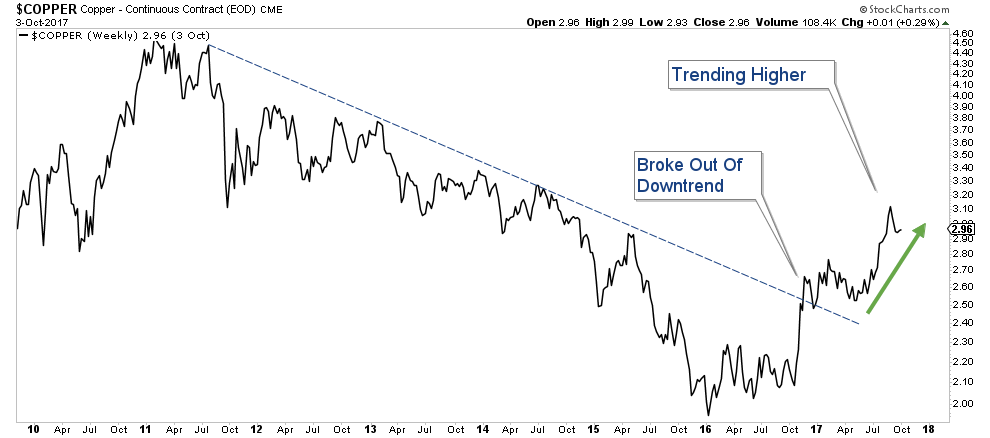

Rising commodity prices are inflationary and in an inflationary environment, yields rise. Because of this relationship, Treasury Yields are highly correlated to Copper. Copper can be a leading indicator of Treasury Yields, so let’s look at a chart of Copper to see if it can give us some insight as to the future direction of yields.

Below is a chart of Copper. As you will notice, it has been in a long-term downtrend as has Treasury Yields. However, price has broken decisively above its downtrend line and has been advancing strongly since it bottomed at the end of last year.

If yields are now going to rise after 35 years of falling, there is a lot of room to advance higher!

Now is the time to evaluate your bond holdings, not later after they fall in value. I can help you review your holdings and discuss ways to protect yourself against the adverse effects of a rising yield environment.

Email me to schedule a free, no obligation phone appointment.

Craig Thompson, ChFC

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.