This email is meant as a follow-up to my last update on bonds and bond yields, titled: Bonds – A Ticking Time Bomb. I am sending this out separately from my weekly newsletter because I view this topic as being so profoundly important. Evidence continues to suggest that we may be at the beginning of reversing a 35-year trend of falling yields. The bottom line is that if bond yields are now going to rise (after 35 years of falling), bond prices are going to fall – potentially a lot. That is going to really hurt those investors that are in or near retirement because you just don’t have the time or income to make up for those losses.

Wealth Manager Brian Raven was recently interviewed on CNBC about his view on bonds and bond yields. Some quotes from his interview:

“This is the biggest financial crisis of our lifetime, because it affects the average person,”

He argued that bond markets are in a state “never seen before” which could soon trigger a financial shock bigger than in 2008.

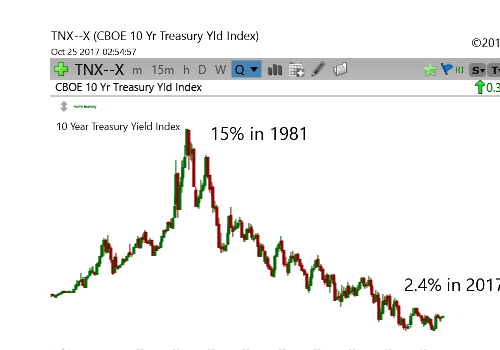

Technical analyst Louise Yamada talked about a rate supercycle on CNBC.  Below is a chart of the 10-year Treasury yield and as you will notice, yields shot higher from July 2016 through the end of that year. Since then, they have been digesting those gains and drifting lower. Recently we have seen those yields advance above their downtrend line and above resistance. In addition, short-term momentum is now suggesting that yields are going to rise.

Below is a chart of the 10-year Treasury yield and as you will notice, yields shot higher from July 2016 through the end of that year. Since then, they have been digesting those gains and drifting lower. Recently we have seen those yields advance above their downtrend line and above resistance. In addition, short-term momentum is now suggesting that yields are going to rise.

Now is the time to evaluate your bond holdings, not later after they fall in value. I can help you review your holdings and discuss ways to protect yourself against the adverse effects of a rising yield environment.

Email me to schedule a free, no obligation phone appointment.

Craig Thompson, ChFC

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.