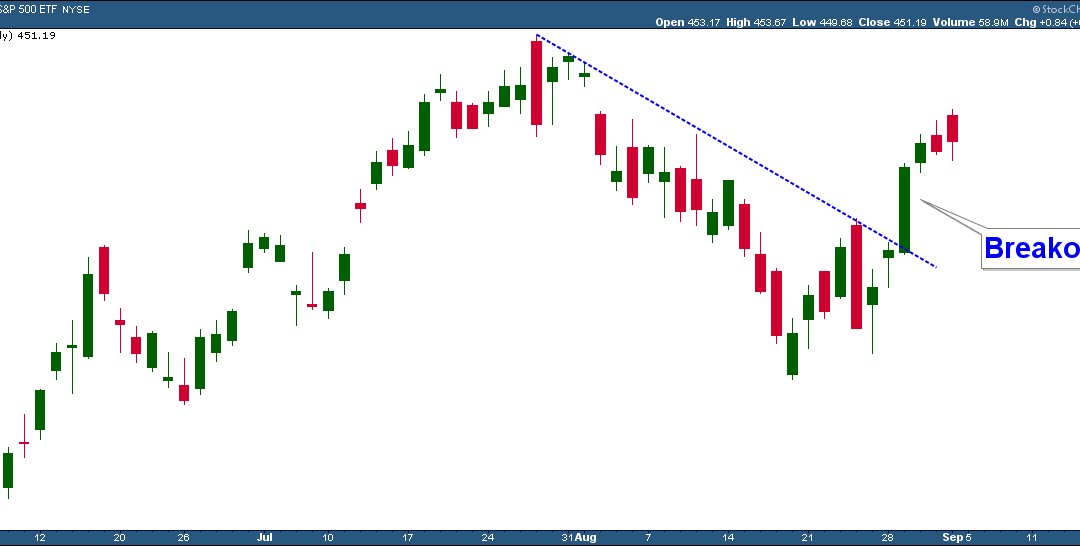

When I wrote last month’s newsletter the S&P 500 was nearing the upper end of its uptrending channel, but was not there yet. Over the past month, major market indexes continued to run higher and the S&P 500 is now at the top of its uptrending channel (see chart below). This is an area in which I would expect some market weakness in the near term. Not a change in trend, just some type of short-term pullback.